What is your vision of a thriving, prosperous life?

We understand that prosperity is as unique as you are. It’s not just about accumulating wealth. It’s about building a financial life consistent with your goals, beliefs, and values.

Empower Your Financial Future with Principled Investing

Wealth Management Rooted in Judeo-Christian Values

At the core of your financial journey lies a profound question: What does real prosperity mean to you? For many, it’s about accumulating substantial assets that can be used to produce retirement income. But it’s also about enjoying life, family, God, and community… and influencing others to do the same.

Therefore, our unconventional wealth management services are designed to help you align your financial goals with your values and beliefs, providing a harmonious blend of conviction and finance.

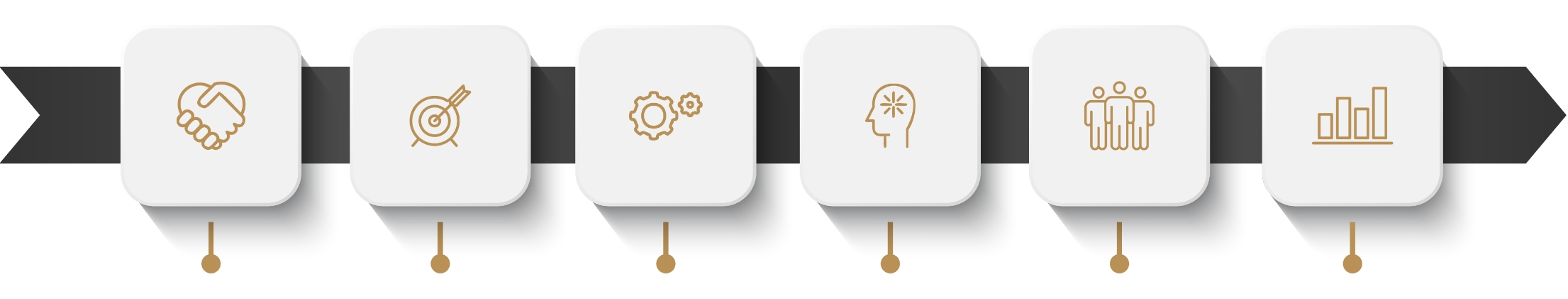

Stewardship

Wealth comes with responsibility, and we enable you to manage your affairs wisely.

Integrity

Our advice is impartial (with no investment product or style bias), tailored to your interests, and committed to your goals.

Service

We aim to develop a lasting, top-tier service relationship with you.

Expertise

With over 25 years of average experience and all advisors being CFP® certified, we excel in meeting the complex needs of wealthy families.

Team Approach

We believe a team of specialists working in alignment provides greater value than one advisor trying to know it all.

Accountability

Your investments are constantly monitored with benchmarks so timely changes can be made. You are kept well-informed about your performance and progress.

Stewardship

Wealth comes with responsibility, and we enable you to manage your affairs wisely.

Integrity

Our advice is impartial (with no investment product or style bias), tailored to your interests, and committed to your goals.

Service

We aim to develop a lasting, top-tier service relationship with you.

Expertise

With over 25 years of average experience and all advisors being CFP® certified, we excel in meeting the complex needs of wealthy families.

Team Approach

We believe a team of specialists working in alignment provides greater value than one advisor trying to know it all.

Accountability

Your investments are constantly monitored with benchmarks so timely changes can be made. You are kept well-informed about your performance and progress.

St. Louis Financial Advisors

The financial advisor you hire to support your financial pursuits is one of the more important decisions you will make for yourself, your family, and future generations.

At Trinity, you get the best thinking of a team of experienced professionals versus an individual advisor trying to do it all. We are intentionally organized to serve the needs of clients first, including assisting with “dirty financial jobs” when needed, and all with a family-like loyalty to our clients. This results in delivering constructive financial progress, while also delivering a deeper, more meaningful purpose for your assets.

COMPLIMENTARY EBOOK

How to Adapt to Life’s Increasingly Complex Financial Twists & Turns

Explore practical strategies to improve your financial security on life’s longer, often unpredictable journey.

How Do Our Differences Benefit You?

What You Will Get

We Listen to You

We have deep, meaningful conversations with you that help you clarify and resolve compromises you must make between your life and financial goals.

Outsource the Financial Work to Us

Think of your assets as a business. We can be your personal CFO, responsible for the day-to-day operation of your asset-based business.

Clarity and Progress

We seek clarity in all of our communications with our clients. We provide frequent updates, so you always know what is happening and, more importantly, why.

Experience

Our St. Louis-based financial advisors team has over 100 years of collective planning and investment experience.

Coordination

We collaborate with other professionals (CPA, attorney, insurance agents, ...) so you avoid conflicting advice and duplicate fees.

What You Won’t Get

Being Sold a Product or Money Management Approach

You won’t be accosted by salespeople wanting to sell you what is best for them.

Cookie-Cutter Financial Plans

We don’t recommend one-size-fits-all financial planning solutions. We don’t believe all 50-year-olds have the same financial requirements.

Technical Investment Jargon

You won’t get communications that include a lot of financial jargon requiring an advanced finance degree to understand.

Junior Staff

You won’t work with inexperienced advisors just starting in the financial service industry. Our team is the epitome of experienced professionals.

A Call Center

Unlike some firms, you will never be required to go through a call center to speak with a senior professional at Trinity.

Stay up-to-date on financial issues that impact your well-being

Discover the Difference

Our approach to financial advising is distinctive, focusing on creating a harmonious relationship with our clients. We like to engage with individuals who share our values. Whether you’re seeking a fresh perspective or are ready to embark on a new financial journey, we invite you to see if we’re the right fit for each other.